Explain the Different Issues of International Capital Budgeting

In this article we discuss capital budgeting why it is important and the different methods you can use. International Risk inclusive of currency risk Industry-specific Risk.

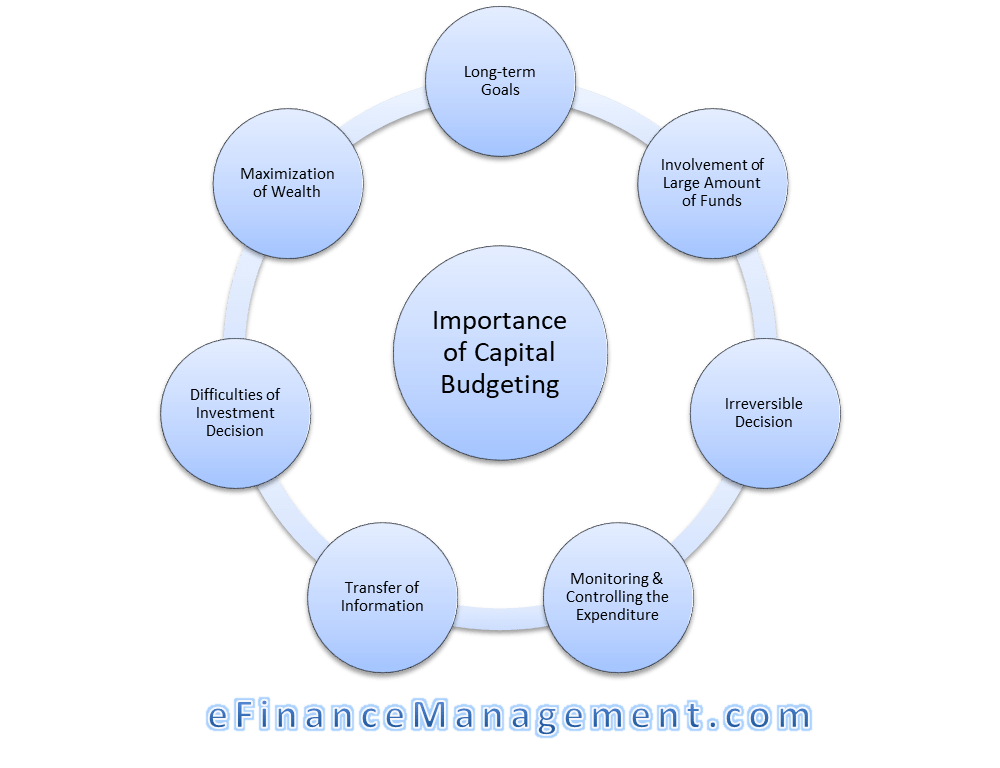

Importance Of Capital Budgeting Meaning Importance

On the other hand current assets are short term by nature.

. The large expenditures include the purchase of fixed assets like land and. 2 Capital export neutrality CEN based on worldwide income. The financing aspect has to be carefully examined by considering the regulating framework in respective.

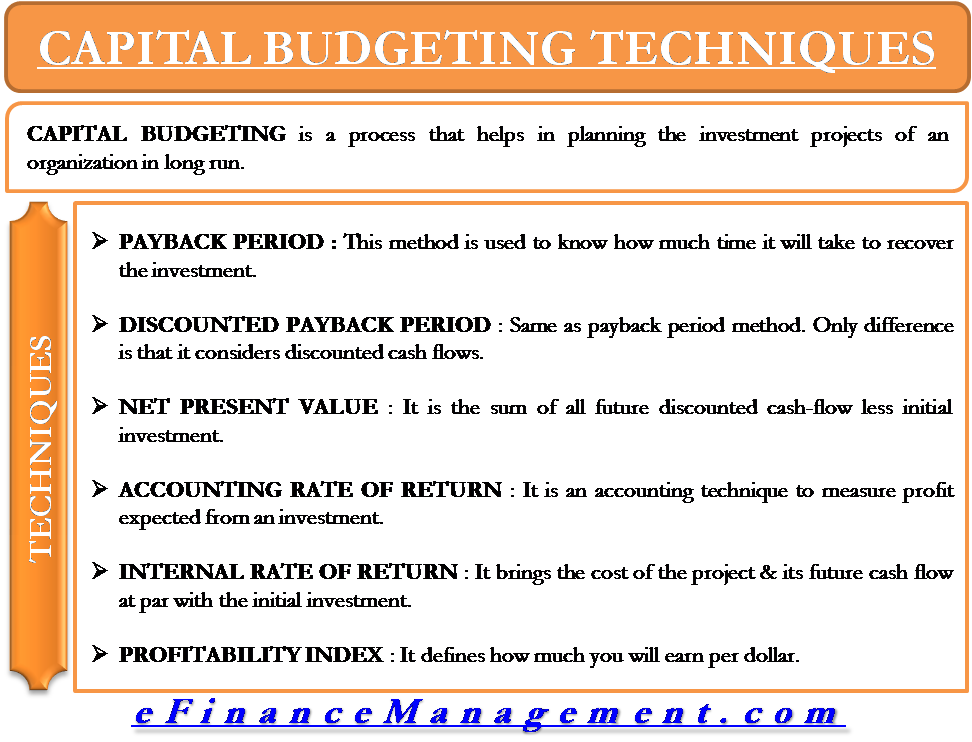

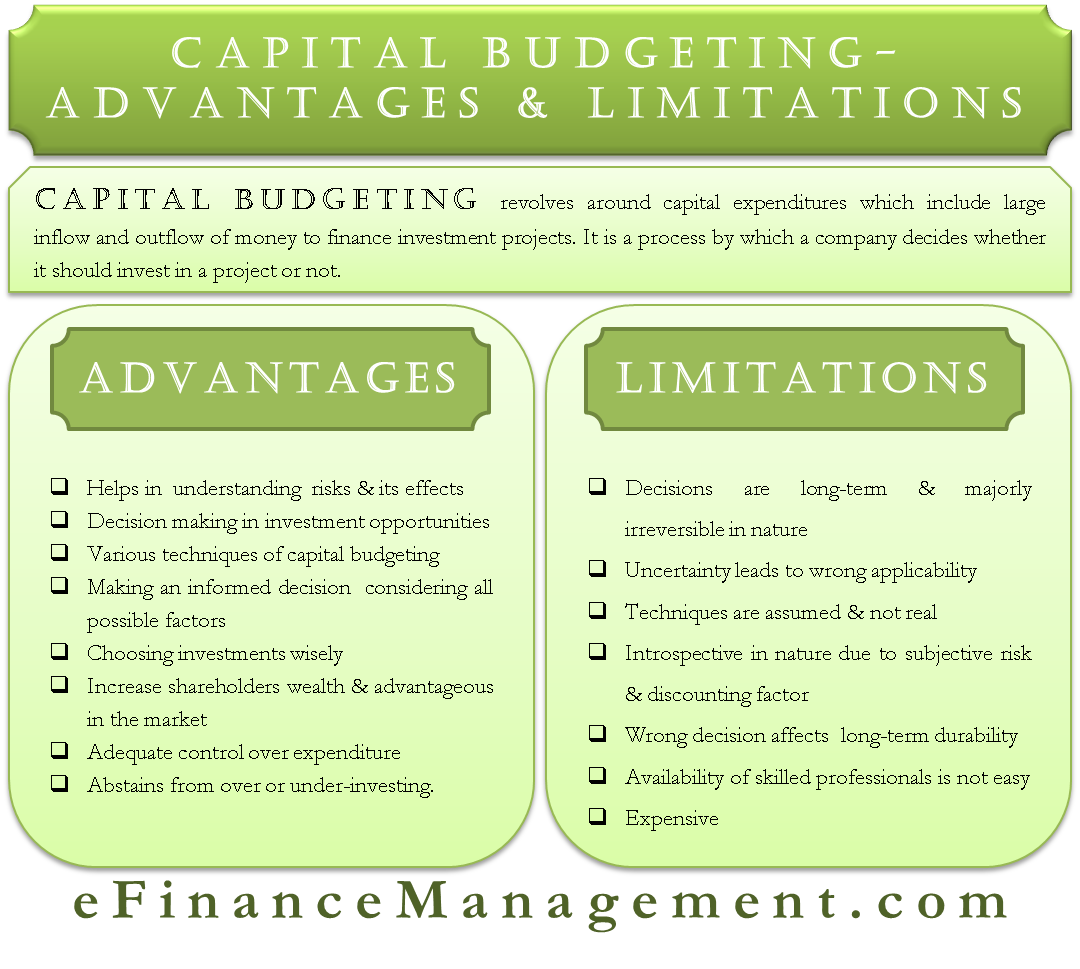

It involves the decision to invest the current funds for addition disposition modification or replacement of fixed assets. Capital budgeting is the process a business undertakes to evaluate potential major projects or investments. We may also said that capital budgeting is technique employed to determine the value of project and investment in fixed assets.

A technique to lower the risk of multinational capital budgeting is to finance the. 4 Expenditure Control. The three most common approaches to project selection are payback period PB internal.

International risk including currency risk industry-specific risk. 3 Decision cannot be Undone. Capital budgeting examines the project from different aspects to find out all possible losses and risks.

In the capital budgeting process each of these risks focuses on an area in which some type of unpredictability could forcibly change the plan of managers. Incremental budgeting computes a budget by applying adjustments to the preceding periods actuals. It enables in identifying the risk associated with investment plans.

Here is the top 10 importance of capital budgeting. 1 Capital import neutrality CIN based on territorial income. Use of segmented capital markets may provide an opportunity or may involve higher costs.

Identification development selections and post-audit. 1 efficiency of for-profit hospitals relative to not-for-profit hospitals 2 capital budgeting practices of the healthcare industry vis-à-vis other industries and 3 effects. The international capital markets allow individuals companies and governments to access more opportunities in different countries to borrow or invest which in turn reduces risk.

From pre-world war 2 years to the early 1980s which country was the principal lender in the world. WendorfCapital Budget 73 CAPITAL BUDGET FROM A LOCAL GOVERNMENT PERSPECTIVE JILL WENDORF Grand Valley State University In this analysis I examine the impacts of a capital budget plan on a local government unit focusing on the process involved in creating developing and implementing a capital budget despite its difficulties. Capital budgeting is the process by which investors determine the value of a potential investment project.

There are numerous kinds of risks to be taken into account when considering capital budgeting including. The cost of capital is usually different based on the type financing used by the company. Understanding the different capital budgeting methods can help you understand the decision-making process of companies and investors.

Capital budgeting techniques are related to investment in fixed assets. Capital budgeting for a small scale expansion involves three steps. Each of these risks addresses an area in which some sort of volatility could forcibly alter the plan of firm managers.

Capital projects are the ones where the company receives the cash flows over long periods of time which exceeds a year. 5 Information Flow. Fixed assets are that portion of balance sheets which are long term in nature.

Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. 6 Helps in Investment Decision. Since the project is being implemented in a different country therefore the capital markets are segmented by space.

The structure of the capital markets falls into two componentsprimary and secondary. From the early 1980s through today the largest net borrower in the world has been. Recording the investments cost projecting the investments cash flows and comparing the projected earnings with inflation rates and the time value of the investment.

The first drawback is that it does not account for the time value of the money involvedmeaning that future returns may be worth significantly less than the returns currently being taken in. Capital budgeting is a companys formal process used for evaluating potential expenditures or investments that are significant in amount. The firm may incur less risk because of international diversification.

Capital financing decisions start with the interest rate or cost of capital companies must pay to borrow money for the new capital budget item. The largest net international lender since 1980 has been. 1 CIN Approach most European countries Canada Hong Kong Singapore - No penalty or advantage attached to the fact that capital is foreign-owned - Foreign capital competes on an equal basis with domestic capital.

In this report we analyze and synthesize these surveys in a four-stage framework of the capital budgeting process. Example of Capital Budgeting. It takes all possible considerations into account so that the company can evaluate the profitability of the project.

Capital budgeting is the planning process used to determine whether an organizations long term investments such as new machinery replacement of machinery new plants new products and research development projects can be done using the firms capitalization structures debt equity or retained earnings to bring profit as well as to increase. Construction of a new plant or a big investment in an outside venture are examples of. Generally the political risk related to foreign investment is added to the required rate of return.

The 5 most common approaches to budgeting. 2 Huge Investments. It is useful for evaluating capital investment projects such as purchasing equipment rebuilding equipment etc.

Following are the types of risks to account for in capital budgeting. Capital budgeting is a process that helps in planning the investment projects of an organization in long run. Under certain conditions the internal rate of return IRR and payback period PB methods are sometimes used instead of net present value NPV which is the most preferred method.

Using the capital budgeting techniques-risk return and investment amount of each project is examined. 1 Long Term Effect on Profitability. The change typically comes in percentage term and could either be an increase or a cutback depending on many factors primarily the organisations needs and situation.

The theory is that not all markets will experience contractions at the same time. Almost all the corporate decisions that impact the companys future earnings can be studied using this framework. We examine three issues in particular.

Capital budgeting is an accounting principle companies use to determine which projects to pursue. The capital budgeting process includes identifying and then evaluating capital projects for the company. A second issue with relying solely on the accounting rate of return in capital budgeting is the lack of acknowledgement of cash flows.

Capital Budgeting Techniques With An Example Meaning Example

No comments for "Explain the Different Issues of International Capital Budgeting"

Post a Comment